Despite President Biden’s pledge not to raise taxes on those making under $400,000 per year, the majority of Americans will pay more in taxes as a result of Democrats ‘inflation reduction bill’ AKA Biden’s failed ‘Build Back Better 2.0’ deal.

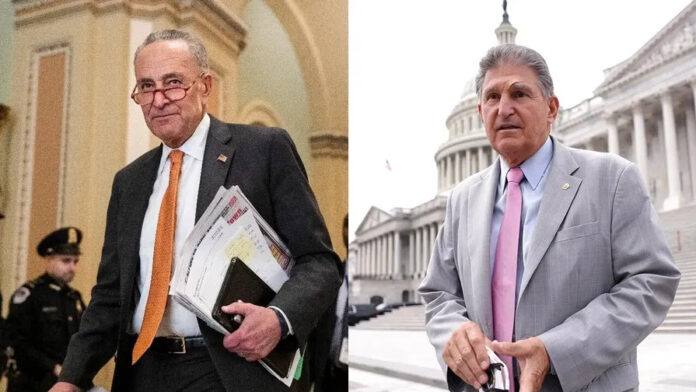

According to a Fox News analysis, The Inflation Reduction Act — unveiled Wednesday by Sen. Joe Manchin, D-W.Va., and endorsed by Biden — would increase tax revenue by $16.7 billion from Americans earning less than $200,000 a year, according to a nonpartisan analysis from the Joint Committee on Taxation (JCT) published Friday. Nearly every tax bracket would pay more in taxes with those making below $10,000 per year seeing the largest uptick, the analysis showed.

“The more this bill is analyzed by impartial experts, the more we can see Democrats are trying to sell the American people a bill of goods,” Senate Finance Committee Ranking Member Mike Crapo, R-Idaho, said in a statement Saturday. “Non-partisan analysts are confirming this bill raises taxes on the middle class and produces no meaningful deficit reduction when gimmicks are removed and the full cost is accounted for.”

Biden has repeatedly promised that Americans earning less than $400,000 per year would not experience any tax increase during his presidency. Several times throughout his campaign he also mentioned that taxes would never be raised on the middle class.

“This bill will not raise taxes on anyone making less than $400,000 a year,” Biden remarked Thursday during a speech about the legislation. “And I promise — a promise I made during the campaign and one which that I’ve have kept.”

In 2023, the year in which the legislation would increase tax revenue most, individuals making less than $10,000 per year would pay 3.1% more in taxes and those making between $20,000-30,000 per year would see a 1.1% tax increase, the JCT analysis showed. Tax revenue collected from those making $100,000 per year or less would increase by $5.8 billion in 2023 under the Inflation Reduction Act.

Fox News also reported that “In addition, the share of tax revenue collected from all Americans making more than $200,000 per year would remain at the current percentage, according to the JCT. Taxpayers with an annual income of $200,000 or greater pay more than 57% of all federal income taxes.”

The Inflation Reduction Act, though, boosts Internal Revenue Service enforcement, a provision that is expected to increase federal tax revenue by $124 billion. The bill also creates a minimum corporate tax rate of 15% which is expected to boost federal tax revenue by $313 billion.

Mike Palicz, the federal affairs manager at Americans for Tax Reform, told FOX Business in an interview that “There’s a $25 billion crude oil tax in this bill. That’s something that’s going to hit everyone. That’s a regressive tax increase on poor people that raises their energy costs, raises the price of gasoline.”

Transportation Secretary Pete Buttigieg previously said that a gasoline tax increase would violate Biden’s pledge not to raise taxes on middle-class Americans.

“This is Biden breaking his promise to the American people,” Palicz said.